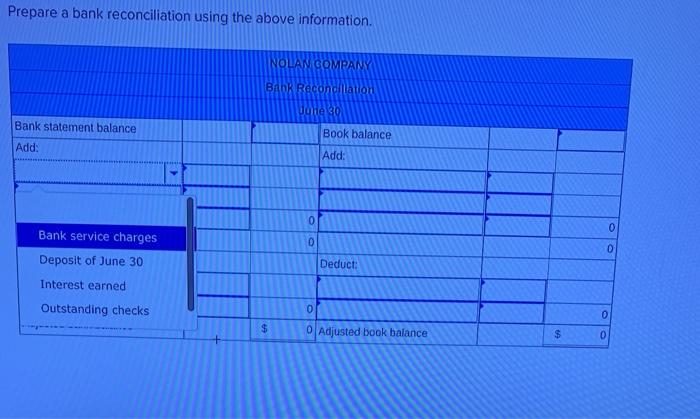

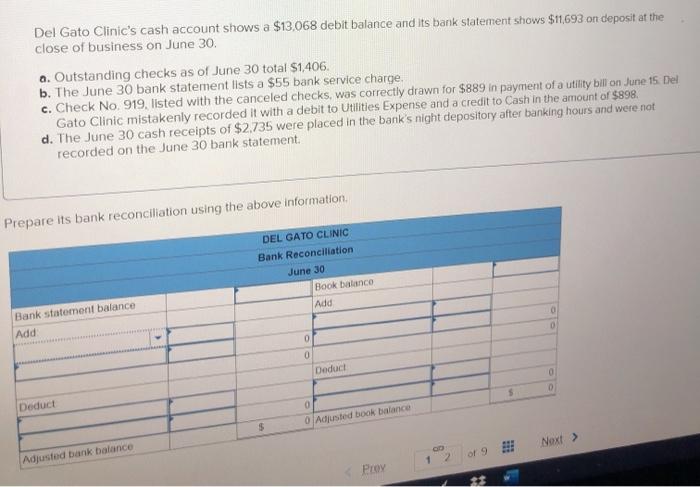

Nolan Company’s cash account shows a discrepancy between the company’s records and bank statements. This discrepancy could be due to a number of factors, including errors in recording transactions, fraud, or theft. It is important to reconcile the cash account regularly to identify and correct any discrepancies.

The process of reconciling the cash account involves comparing the company’s records to the bank statements and identifying any differences. Once the differences have been identified, they must be investigated and corrected. Reconciling the cash account is an important part of internal control and helps to ensure the accuracy of the financial statements.

1. Company’s Cash Account Discrepancies

Reconciling the cash account is crucial for ensuring the accuracy of financial records. It involves comparing the company’s internal records with bank statements to identify and resolve any differences.

Discrepancies can arise due to various reasons, including errors in recording transactions, bank charges, outstanding checks, and deposits in transit.

2. Reconciling Procedures

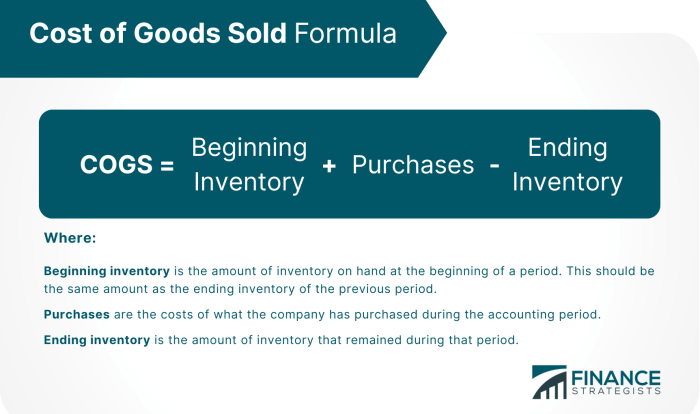

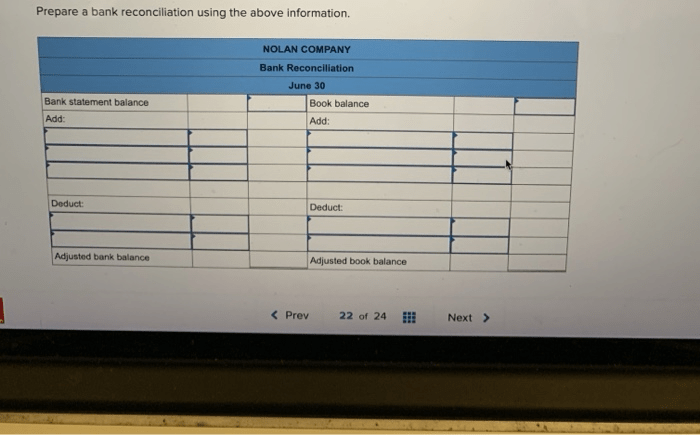

Cash account reconciliation involves a systematic process:

- Compare the beginning cash balance on the bank statement with the internal records.

- Review all transactions recorded in the internal records but not yet reflected on the bank statement.

- Examine all bank transactions not yet recorded in the internal records.

- Identify and adjust for any reconciling items, such as outstanding checks or deposits in transit.

- Ensure that the adjusted cash balance matches the bank statement balance.

Timely reconciliation is essential for maintaining accurate financial records and preventing errors.

3. Cash Flow Analysis

The cash account plays a vital role in understanding a company’s cash flow.

| Activity | Cash Flow |

|---|---|

| Operating | Net income + depreciation + changes in working capital |

| Investing | Purchase/sale of assets + investments |

| Financing | Issuance/repayment of debt + equity |

Analyzing cash flow provides insights into a company’s financial health, liquidity, and ability to meet obligations.

4. Internal Controls for Cash

Internal controls are essential for safeguarding cash:

- Establish clear authorization procedures for cash transactions.

- Implement segregation of duties to prevent fraud.

- Reconcile cash accounts regularly.

- Perform physical cash counts periodically.

- Use a petty cash fund for small transactions.

Proper internal controls can prevent errors, reduce the risk of fraud, and ensure the accuracy of financial records.

5. Impact on Financial Statements

Cash account discrepancies can impact financial statements:

- Unreconciled cash can overstate or understate the cash balance on the balance sheet.

- Errors in recording cash transactions can affect the accuracy of the income statement.

Unreconciled cash can lead to misstated financial statements, which can mislead investors and creditors.

6. Industry Best Practices: Nolan Company’s Cash Account Shows A

Effective cash management practices include:

- Maintaining a positive cash flow.

- Optimizing accounts receivable and payable.

- Investing excess cash wisely.

- Using technology to automate cash management processes.

Implementing best practices can improve a company’s financial performance and reduce the risk of cash flow problems.

Answers to Common Questions

What is the purpose of reconciling the cash account?

The purpose of reconciling the cash account is to identify and correct any discrepancies between the company’s records and the bank statements.

What are some of the potential reasons for discrepancies between the company’s records and the bank statements?

Some of the potential reasons for discrepancies between the company’s records and the bank statements include errors in recording transactions, fraud, or theft.

How often should the cash account be reconciled?

The cash account should be reconciled regularly, such as monthly or quarterly.