Overstating ending inventory will overstate all of the following except net income. This is because overstating ending inventory will lead to an overstatement of assets and an understatement of expenses, which will result in an overstatement of net income. However, it is important to note that overstating ending inventory will not affect net income in the long run, as the overstatement will eventually be corrected in future periods.

The overstatement of ending inventory can have a significant impact on a company’s financial statements. It can lead to an overstatement of assets, an understatement of expenses, and an overstatement of net income. This can have a negative impact on the company’s financial ratios and can mislead investors and creditors.

Overstating Ending Inventory

![]()

Overstating ending inventory is an accounting error that results in an overstatement of assets and net income. This can have serious consequences for a company, as it can lead to misleading financial statements and incorrect decision-making.

Overstatement of Assets and Liabilities, Overstating ending inventory will overstate all of the following except

Ending inventory is an asset, and overstating it will directly impact total assets. This can lead to an overstatement of current assets, which can in turn affect current liabilities. For example, if a company overstates its ending inventory, it will have a higher current ratio, which may make it appear more creditworthy to lenders.

However, this is a false impression, as the company’s actual liquidity may be lower than it appears.Overstating ending inventory can also affect non-current liabilities. For example, if a company overstates its ending inventory, it will have a lower debt-to-equity ratio, which may make it appear less risky to investors.

However, this is also a false impression, as the company’s actual debt burden may be higher than it appears.

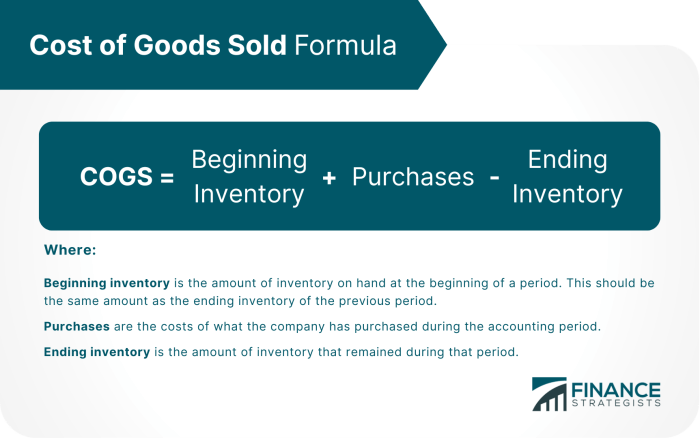

Impact on Cost of Goods Sold (COGS)

Ending inventory is used to calculate the cost of goods sold (COGS). If ending inventory is overstated, it will result in an understatement of COGS in the current period. This will lead to an overstatement of gross profit margin. In future periods, the overstated ending inventory will lead to an overstatement of COGS and an understatement of gross profit margin.

Effects on Net Income

Overstating ending inventory will lead to an overstatement of net income in the current period. This is because net income is calculated by subtracting COGS from revenue. If COGS is understated, then net income will be overstated. In future periods, the overstated ending inventory will lead to an understatement of net income.

Implications for Financial Ratios

Financial ratios are used to analyze a company’s financial performance. Overstating ending inventory can distort these ratios and provide misleading information. For example, overstating ending inventory can lead to an overstatement of the current ratio, debt-to-equity ratio, and gross profit margin.

This can make a company appear more financially healthy than it actually is.

Clarifying Questions: Overstating Ending Inventory Will Overstate All Of The Following Except

What are the consequences of overstating ending inventory?

Overstating ending inventory can lead to an overstatement of assets, an understatement of expenses, and an overstatement of net income. This can have a negative impact on the company’s financial ratios and can mislead investors and creditors.

How can I avoid overstating ending inventory?

Companies can avoid overstating ending inventory by having accurate inventory records. This includes using a perpetual inventory system, taking physical inventory counts regularly, and using proper costing methods.