Step into the world of healthcare savings and enhanced access with H5521 425 04 – Local PPO. Dive into this comprehensive guide that unravels the intricacies of local PPOs, their advantages, and how they revolutionize healthcare delivery.

Local PPOs (Preferred Provider Organizations) are reshaping the healthcare landscape, offering cost-effective solutions and expanding access to quality care. Discover how H5521 425 04 empowers individuals and communities to navigate the healthcare system with greater ease and affordability.

Local PPOs (Preferred Provider Organizations)

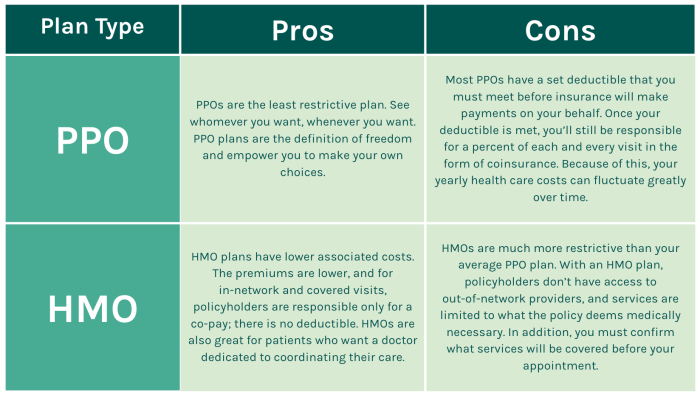

Local PPOs (Preferred Provider Organizations) are healthcare networks that contract with providers in a specific geographic area to provide discounted services to their members. These organizations aim to reduce healthcare costs while ensuring access to quality care.

Advantages of Local PPOs

- Reduced Costs:PPOs negotiate lower rates with providers, leading to lower out-of-pocket expenses for members.

- Wide Network:Local PPOs typically have a large network of providers, ensuring convenient access to care.

- Flexibility:Members can choose from a variety of providers within the network, offering flexibility in selecting the right healthcare professionals.

Disadvantages of Local PPOs

- Limited Coverage:Local PPOs may have a limited geographic reach, which can restrict access to care outside the network.

- Referral Requirements:Some PPOs require referrals from primary care physicians to access specialists, which can add time and complexity to the healthcare process.

- Higher Premiums:PPOs may have higher premiums compared to other types of health insurance plans.

Examples of Local PPOs

Examples of local PPOs in different regions include:

- Aetna Health Plans (Northeastern United States)

- Blue Cross Blue Shield of California (California)

- Humana Health Plan of Florida (Florida)

H5521 425 04

Local PPO Code

Local PPO Code

The H5521 425 04 code is a Local Preferred Provider Organization (PPO) code used in healthcare claims processing. It identifies a specific PPO plan and is essential for accurate reimbursement.This code plays a crucial role in ensuring that claims are processed correctly and that providers receive appropriate payment.

It allows insurance companies to determine the specific PPO plan that a patient is enrolled in, which determines the coverage, benefits, and reimbursement rates applicable to their claim.

Using the H5521 425 04 Code, H5521 425 04 – local ppo

The H5521 425 04 code should be included on all healthcare claims submitted to insurance companies. It should be entered in the appropriate field on the claim form, typically labeled “Local PPO Code” or “PPO Plan Code.”Accurate use of the H5521 425 04 code is important to avoid claim denials or delays.

Providers should ensure that the code they are using matches the PPO plan that the patient is enrolled in. Insurance companies may also use the code to verify patient eligibility and coverage.

The local PPO, h5521 425 04, is committed to providing quality healthcare services. In the spirit of self-discovery, you might also enjoy reading a what my name means poem . As we delve deeper into our identities, we can better appreciate the unique contributions of h5521 425 04 to our community’s well-being.

Benefits of Local PPOs: H5521 425 04 – Local Ppo

Local PPOs offer several advantages that make them an attractive option for individuals and families. These include:

Cost-Saving Benefits

Local PPOs typically have lower premiums and deductibles than traditional health insurance plans. This is because they negotiate discounted rates with healthcare providers in their network. As a result, members can save money on their healthcare expenses.

Improved Access to Healthcare Services

Local PPOs have a wide network of healthcare providers, including primary care physicians, specialists, and hospitals. This makes it easier for members to find the care they need, when they need it.

Quality of Care

Local PPOs are committed to providing quality care to their members. They have strict standards that healthcare providers must meet in order to be part of their network. This ensures that members receive the best possible care.

Challenges of Local PPOs

Local PPOs face several challenges in the healthcare industry, including:

- Competition from larger, national PPOs:National PPOs often have larger networks of providers and can offer lower prices to employers.

- Limited provider networks:Local PPOs typically have smaller provider networks than national PPOs, which can make it difficult for members to find in-network providers in some areas.

- Administrative costs:Local PPOs have to pay administrative costs, such as marketing and claims processing, which can eat into their profits.

Local PPOs can overcome these challenges by:

- Developing strong relationships with local providers:Local PPOs can build strong relationships with local providers by offering them favorable terms and conditions.

- Offering unique benefits:Local PPOs can offer unique benefits, such as lower co-pays or deductibles, to attract members.

- Partnering with other local businesses:Local PPOs can partner with other local businesses, such as employers and health clubs, to offer joint programs and discounts.

Here are some case studies of successful local PPOs that have overcome challenges:

- Blue Cross Blue Shield of Rhode Island:Blue Cross Blue Shield of Rhode Island is a local PPO that has been successful in competing with national PPOs by offering a wide range of benefits and services to its members.

- Harvard Pilgrim Health Care:Harvard Pilgrim Health Care is a local PPO that has been successful in building a strong network of providers by offering them favorable terms and conditions.

- Kaiser Permanente:Kaiser Permanente is a local PPO that has been successful in offering unique benefits to its members, such as lower co-pays and deductibles.

Future of Local PPOs

Local PPOs are expected to play a significant role in the future of healthcare delivery. With their focus on cost-effectiveness, provider networks, and patient satisfaction, local PPOs are well-positioned to adapt to the changing healthcare landscape.One of the key trends expected to shape the future of local PPOs is the increasing use of technology.

Local PPOs can leverage technology to improve care coordination, reduce costs, and enhance patient engagement. For example, local PPOs can use electronic health records (EHRs) to share patient information securely among providers, reducing the risk of medical errors and improving care coordination.Another

trend expected to impact local PPOs is the increasing focus on value-based care. Value-based care is a healthcare delivery model that emphasizes the quality and outcomes of care rather than the quantity of services provided. Local PPOs can align their incentives with value-based care by rewarding providers for delivering high-quality, cost-effective care.

Adapting to Changing Healthcare Regulations

Local PPOs will also need to adapt to changing healthcare regulations. The Affordable Care Act (ACA) has already had a significant impact on local PPOs, and further changes are expected in the future. Local PPOs will need to be flexible and adaptable in order to comply with changing regulations and continue to provide affordable, high-quality care to their members.

Role in Healthcare Delivery

In the future, local PPOs are expected to play a key role in healthcare delivery. They will continue to provide affordable, high-quality care to their members, and they will also play a role in promoting value-based care and improving care coordination.

Local PPOs are well-positioned to meet the challenges of the future, and they are expected to play a vital role in the healthcare system for years to come.

Essential Questionnaire

What is the purpose of H5521 425 04- Local PPO?

H5521 425 04 is a code used to process healthcare claims within local PPO networks, ensuring accurate reimbursement and streamlined billing.

How do local PPOs benefit patients?

Local PPOs offer cost savings through negotiated rates with healthcare providers, expanded access to a network of qualified providers, and improved quality of care through performance monitoring and peer review.

What are the challenges faced by local PPOs?

Local PPOs navigate challenges such as maintaining provider networks, ensuring quality of care, and adapting to evolving healthcare regulations.